prince william county real estate tax due dates 2021

Early Wednesday morning the Board of County. Prince william county real estate tax due dates.

Facility Event Rental The Prince William County Fair

300000 100 x 12075 362250.

. Aircraft 000001 Volunteer Fire Rescue Members Vehicle 000001 Auxiliary Volunteer Fire Rescue Members Vehicle 000001. First Half Real Estate Taxes Due Treasurers Office June 15. Personal Property Taxes and Vehicle License Fees Due.

Purchase a Subscription. To help businesses impacted by the economic impact of COVID-19 the County has extended the Business Tangible Personal BTP Property tax filing deadline from April 15 2021 to May 17 2021. Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday.

Prince William County collects on average 09 of a propertys assessed fair market value as property tax. The new due date is february 3. The due date for 2nd half 2021 real estate taxes is december 6 2021.

By mail to po box 1600 merrifield va 22116. Prince William County has one of the highest median property taxes in the United States and is. 00001 per 100 of assessed value for property tax classifications listed below no tax bills are generated if the assessed value is 50000000 or less.

Estimated Tax Payment 2 Due Treasurers Office June 30. Click here to register for an account or here to login if you already have an account. Where do I pay personal property tax in Prince William County VA.

Prince William County personal property taxes for 2021 are due on October 5 2021. By creating an account you will have access to balance and account information notifications etc. All you need is your tax account number and your checkbook or credit card.

2 nd half 2021 real estate tax bills were due december 6 2021. Prince William supervisors approve advertising tax rate. The new tax rates are effective as of January 1 2021 and will be used for the spring tax collection.

If you have any question regarding your amount call in advance of the due date at 614-525-3438 You can pay online at treasurerfranklincountyohiogov Gross Real Estate Taxes for 2021 Tax Reduction Subtotal-Adjusted Tax Non-Business Credit 87786 Owner Occupancy Credit Homestead. The tax rate is expressed in dollars per one hundred dollars of assessed value. Payments must be postmarked by july 15 to avoid a late fee.

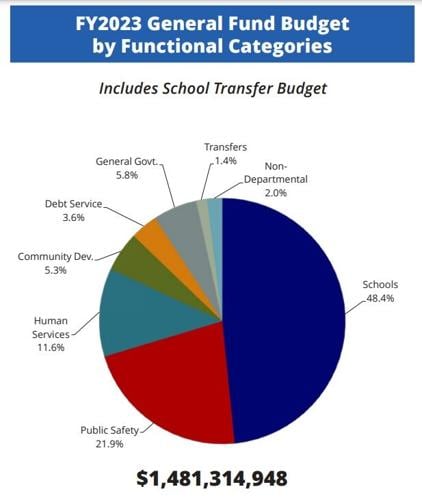

Due to the high volume of emails we are receiving please note that response times are longer than normal. Prince william county tax collector va The county is proposing a decrease in the residential real estate tax rate from 1115 per 100 of assessed value to 105. New Applications for Tax Relief for Elderly Due Commissioner of the Revenues Office July 1.

Due to the low tax rate 00001 per 100 of assessed value for property tax classifications listed below no tax bills are generated if the assessed value is 50000000 or less. A prorated tax bill is applied to vehicles. Due to the low tax rate.

FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or Holiday the due date or deadline is the following business date. Personal property tax bills are mailed late summer with payment due October 5 unless this date falls on a weekend or holiday then the due date is moved to the next business day. May 9 2022 - Tax Sale ends at 200 pm.

17 2020 the Prince William Board of County Supervisors passed a resolution extending the payment deadline for real estate taxes for the second-half of 2020 for 60 days The deadline has bee changed from Dec. Business personal property filing deadline. Payment by e-check is a free service.

Successful bidders must wire the total amount due for all winning certificates purchased including the high bid premium no later than 400 pm. The tax rate is express in dollars per one hundred dollars of assessed value. Prince William County Real Estate Tax Due Dates.

To help businesses impacted by the economic impact of COVID-19 the County has extended the Business Tangible Personal BTP Property tax. Personal Property Taxes Due Real Estate Taxes Due August 1. The board voted unanimously to defer payments for the first half of annual real estate taxes originally due today July 15 -- until Oct.

13 rows July 1. You can pay a bill without logging in using this screen. Business License Tax Due Treasurers Office September 15.

Second-half Real Estate Taxes Due. On May 10 2022 the day following tax sale. Your patience is appreciated.

How will i recieve my pets license and annual renewal notice. Yearly median tax in Prince William County. Business Personal Property Filing Deadline Machinery Tools Filing Deadline February 15 Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date.

Estimated Tax Payment 3 Due Treasurers Office October 5. 2021 taxes due June 20 2022. During a meeting on Nov.

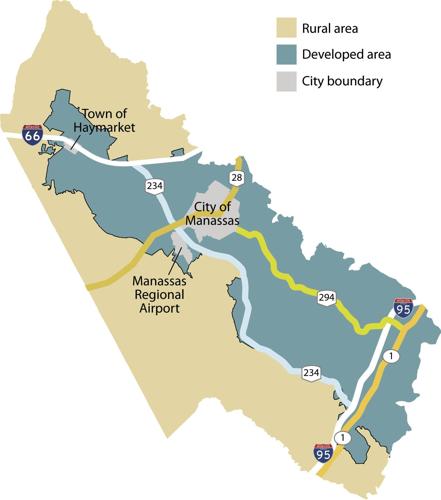

First-half Real Estate Taxes Due. The extension applies to both commercial and residential real property. Prince William County Virginia Sales Tax Rate Property Taxes Prince Georges County MD Arlington County.

Real Estate Tax - Prince William County Virginia. This extension will provide relief to the Countys business owners during this continued period of business interruptions. A convenience fee is added to payments by credit or debit card.

The real estate tax is paid in two annual installments as shown on the. 4 2021 a 10 penalty is applied and starting March 1 2021 interest at 10 per annum begins to accrue on any unpaid amount of this real estate tax for the second-half of 2020. The due date for 2nd half 2021 real estate taxes is december 6 2021.

State Income Tax Filing Deadline State Estimated Taxes Due Voucher 1 June 5. All successful bidderspurchasers will be notified by e-mail by 5pm. Business License Renewals Due.

Please contact Taxpayer Services at 703-792-6710 M-F 8AM 5PM. Provided by Prince William County. Board of Equalization Appeal Deadline for Real Estate Assessment.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as. 5 2020 to Feb.

March 23 2021.

Class Specifications Sorted By Classtitle Ascending Prince William County

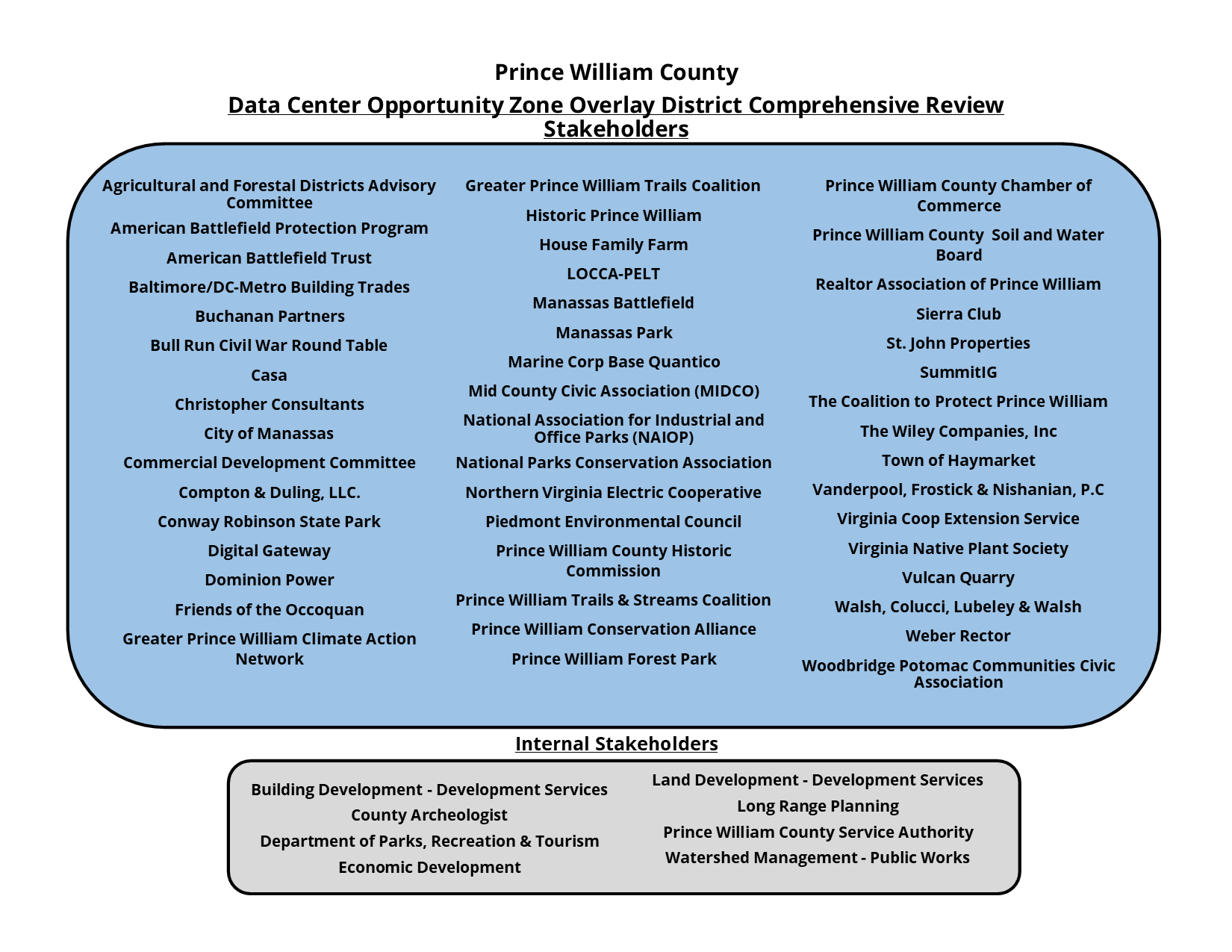

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William Prosecutors Seek More County Funding Headlines Insidenova Com

Personal Property Taxes For Prince William Residents Due October 5

Where Residents Pay More In Taxes In Northern Va Wtop News

Prince William County Va Real Estate Market Realtor Com

Prince William Supervisors Dig In On Comprehensive Plan Update Headlines Insidenova Com

Prince William County Votes To Pause Gainesville Data Center Development Dcd

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Headlines Insidenova Com

2022 Best Places To Raise A Family In Prince William County Va Niche

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William Wants To Hike Property Taxes Introduces Meals Tax